Earn unlimited cash back

Get rewarded for everyday purchases, and so much more. Apply for the Venmo Credit Card with no impact to your credit score if declined.1

Earn

unlimited

cash back

Get rewarded for everyday purchases, and so much more. Apply for the Venmo Credit Card with no impact to your credit score if declined.1

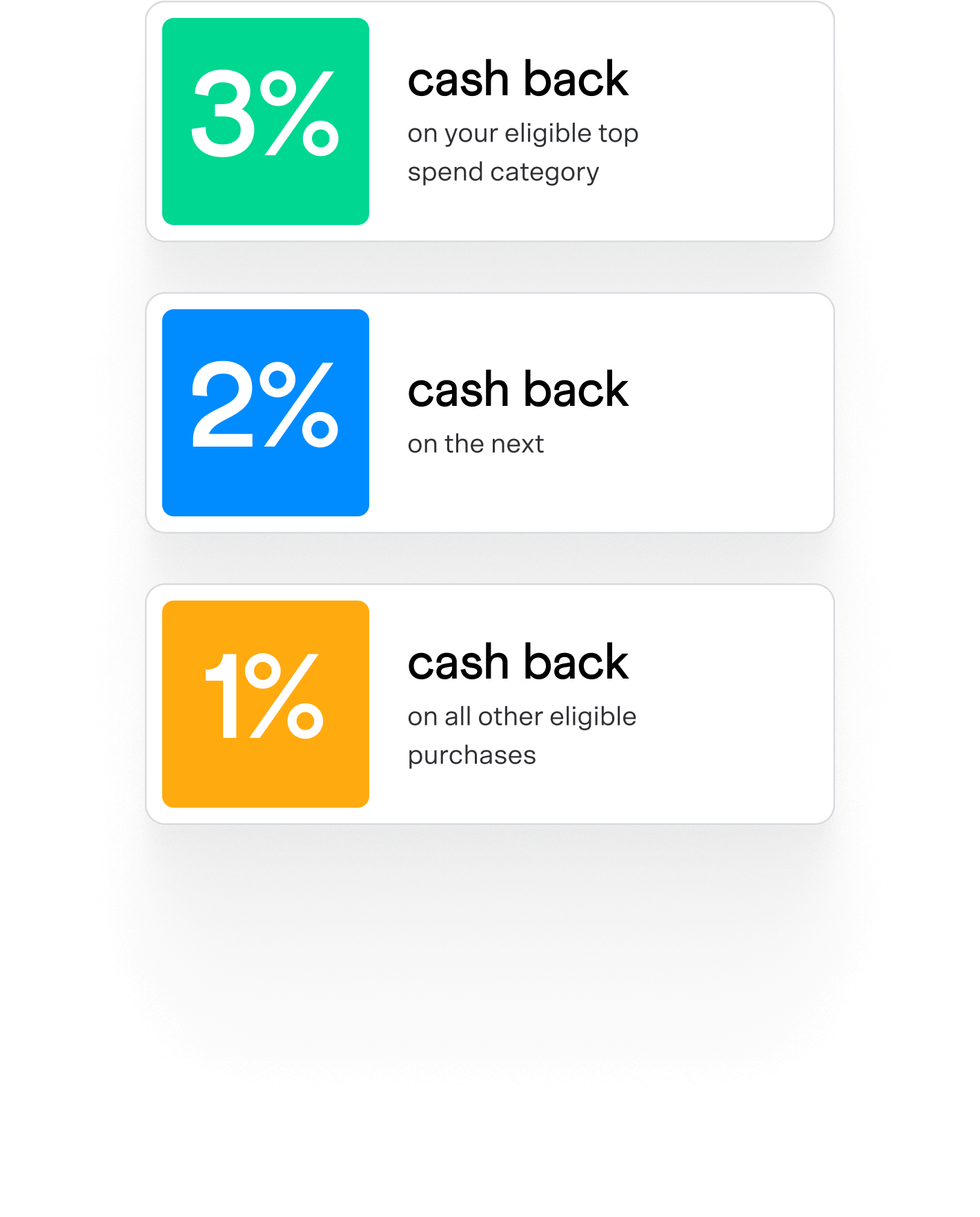

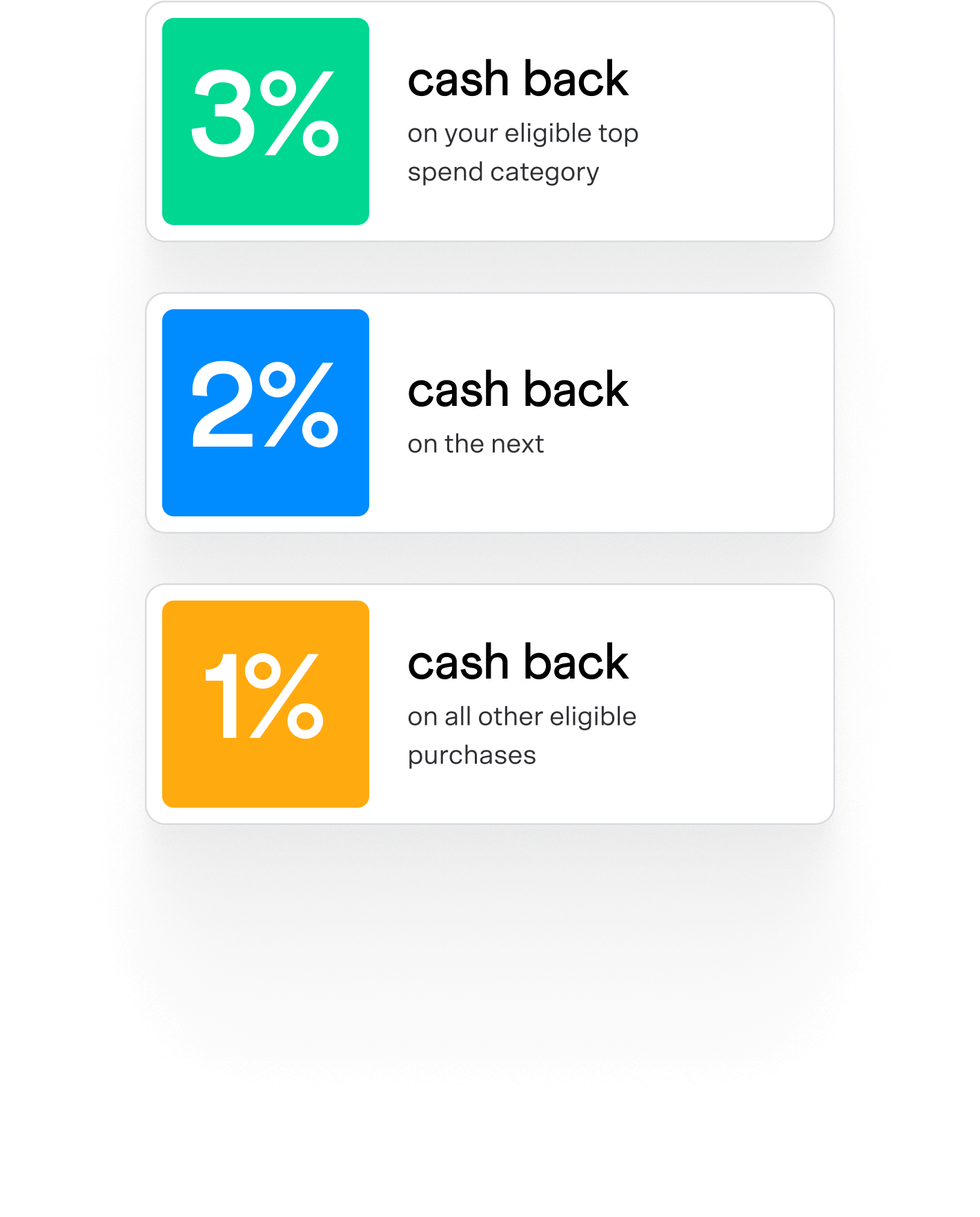

Score up to 3% back on eligible purchases

The Venmo Credit Card lets you shop by your own rules. Travel, grab dinner, and more, while earning maximum cash back across eight spend categories that are always eligible for rewards. You’ll automatically earn 3% cash back on your top spend category, 2% on the next, and 1% on all other eligible purchases.2

No tracking categories, no monthly rewards limits, and no annual fee.3

Travel

Includes: airlines, hotels, motels, and resorts; plus cabins, cruises, cottages, hostels, and more.

Dining & Nightlife

Includes: restaurants, carry out, drive-throughs and delivery; plus, bars and liquor stores.

Groceries

Includes: convenience stores, bakeries and delis, wholesale clubs, and more.

Entertainment

Includes: movie theaters, concerts, game stores, books, amusement parks, music stores, and more.

Bills & Utilities

Includes: phone and internet, streaming services, electric, gas, water and more.

These categories are the most popular, but you can explore the full list of eligible spend categories.

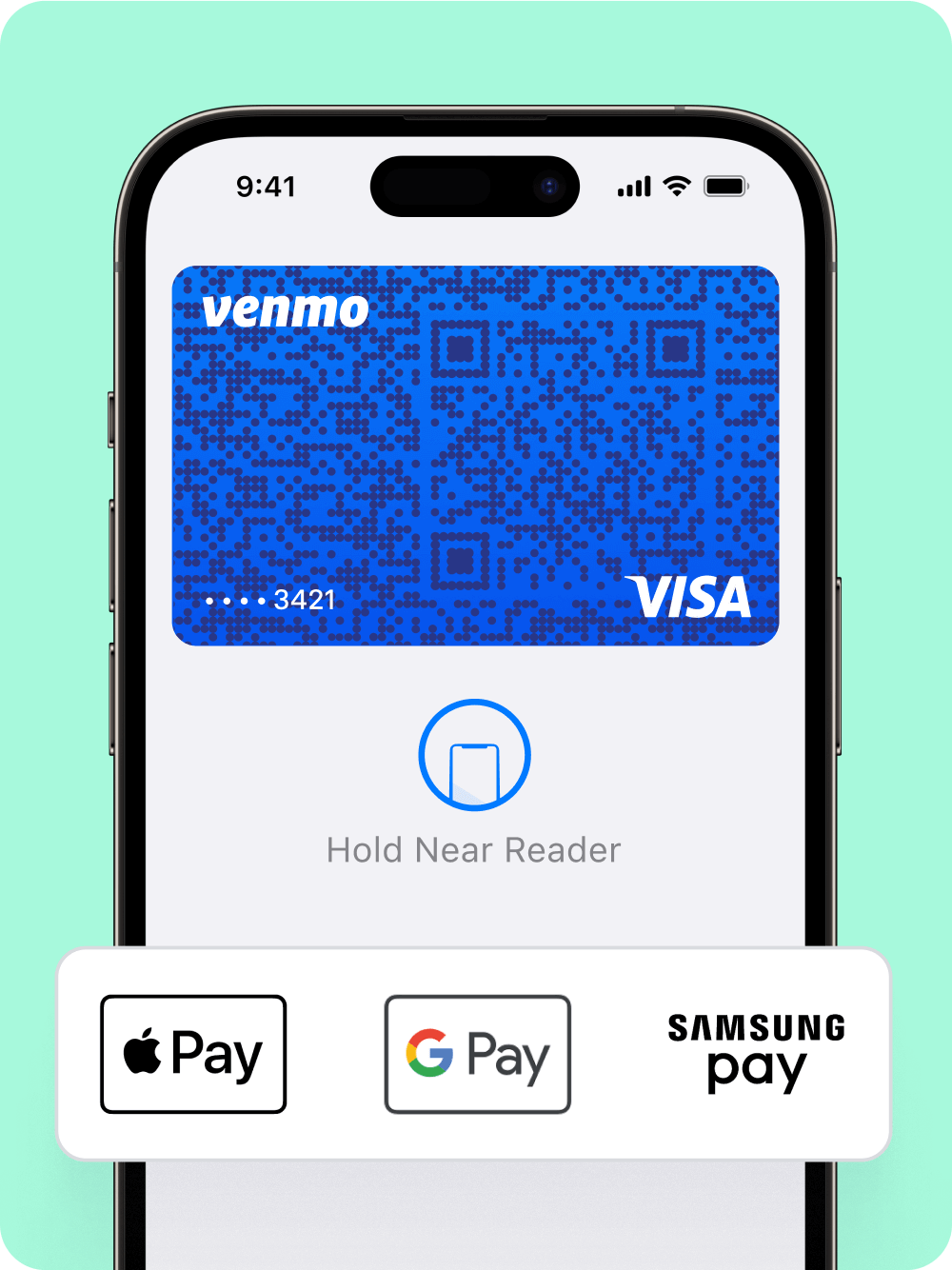

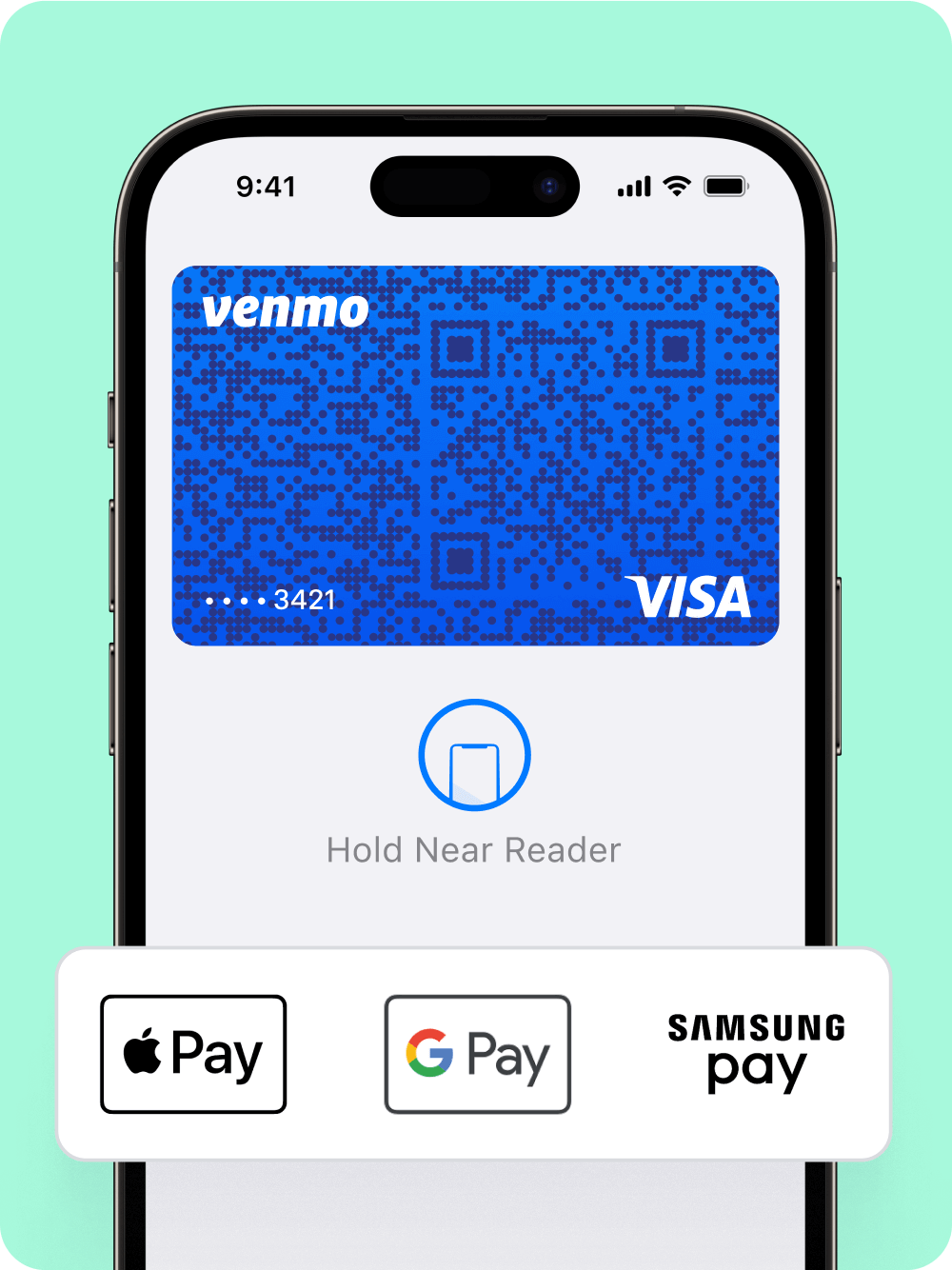

Pay fast,

using your phone

The Venmo Credit Card can be added to mobile wallets for convenient checkout with Apple Pay®, Google Pay™, or Samsung Pay®. Just enter your card details once, then tap, pay, and be on your way.4

You’ll still earn up to 3% cash back on eligible purchases, even when paying with your phone or smart watch.

Learn more about using our card with Apple Pay and other mobile wallets.

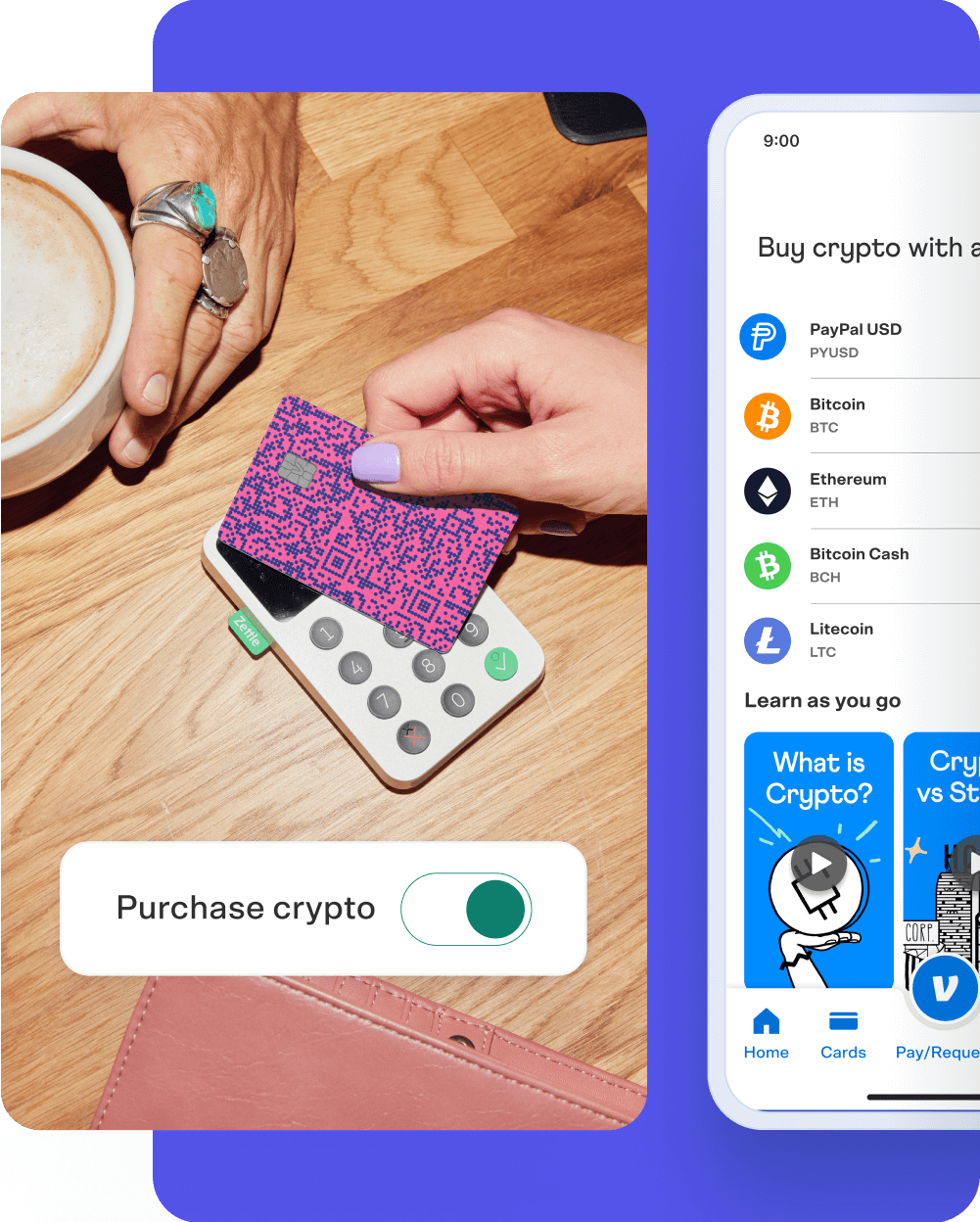

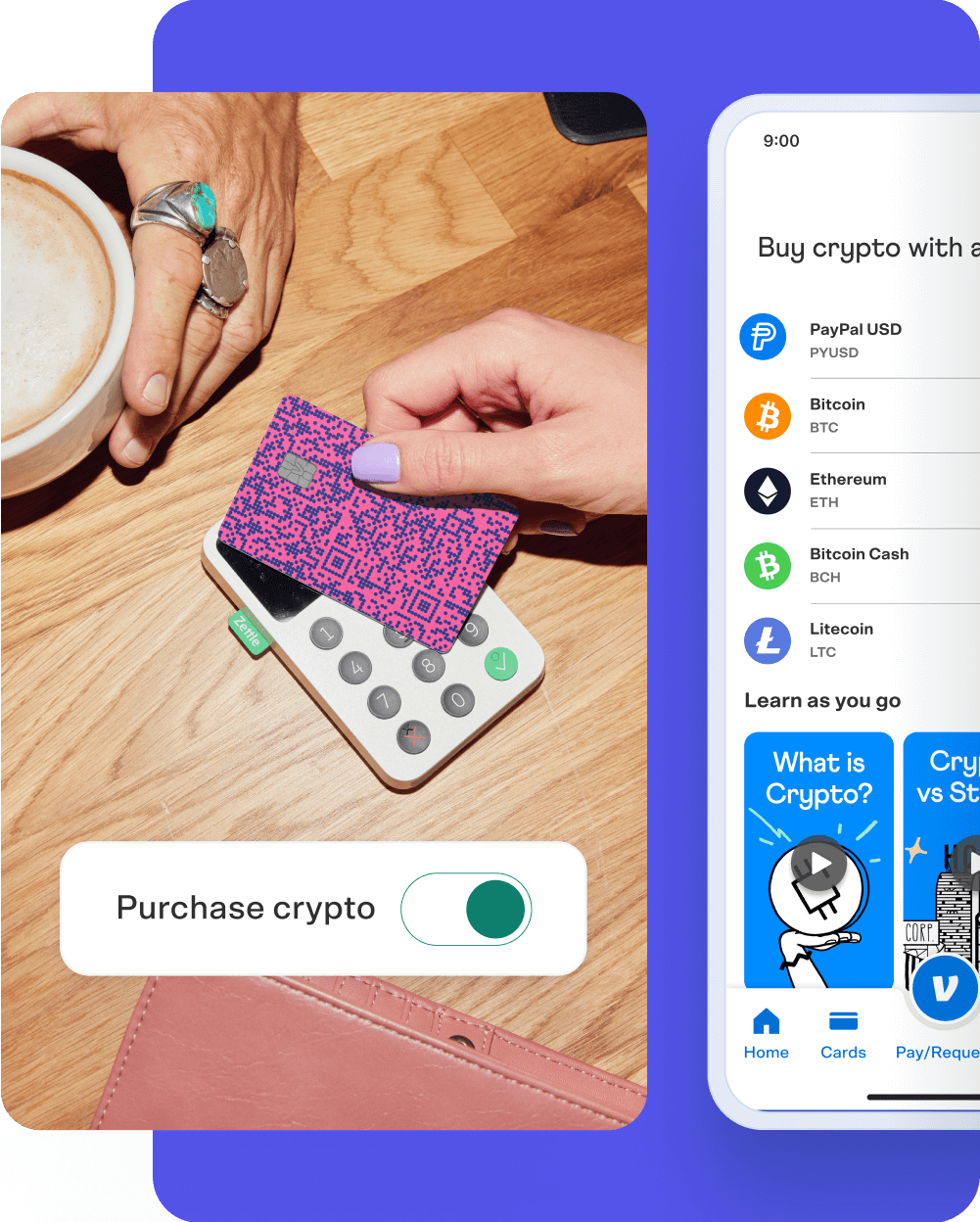

Turn cash back into crypto

You can auto-purchase crypto with the cash back in your Venmo account every month.5 Just turn on the Purchase Crypto feature in the app and choose your favorite type.

We'll take care of the purchase - all without a crypto purchase transaction fee. Learn more.

Crypto is volatile, so it can rise and fall in value quickly. Like all currencies, there’s potential for gains and losses—be sure to take it at a pace you’re comfortable with.

Plus, tons of other perks

Split the bill

in a snap

Your card comes with a unique QR code that links to your Venmo account. Have friends scan it to pay for their share of dinner.

Manage everything in the app

Track spending, rewards, and crypto purchases right from your phone - all with Venmo.

Start earning cash back ASAP

Once approved, you can find your virtual card number in the app, and shop online before your physical card arrives.

Tap into exclusive Visa® features

Your card comes with Visa Credit Card benefits like touch-free shopping, worry-free security,6 and more. Plus, Visa Signature® cardholders get extra travel and lifestyle perks.

Earn cash back with no annual fee3

Start earning up to 3% cash back today. There's no impact to your credit score if you aren't approved.

1Application subject to credit approval. You must be at least 18 years old and reside in the US or its territories to apply. You must have a Venmo account in good standing, that has been open for at least 30 days prior to application. An approved Venmo Credit Card application will result in a hard credit inquiry, which may impact your credit bureau score. Pre-approved offers can only be accepted through the Venmo app.

2See Venmo Credit Card Rewards Program Terms. Use of cash back is subject to the terms of the Venmo User Agreement.

3See Terms & Rates for New Accounts.

4Not available on all devices. For a list of compatible devices, visit apple.com/applepay, google.com/pay, and samsung.com/pay.

5See Cash Back to Crypto Terms. When you buy or sell cryptocurrency, an exchange rate and any fees you will be charged for that transaction will be disclosed to you. The exchange rate includes a spread that Venmo earns on each purchase and sale. The transaction fee will be 0% only when using the automatic purchase feature to use Venmo Credit Card cash back rewards. Trading cryptocurrency is subject to a number of risks and may result in significant losses. Venmo does not make any recommendations regarding buying or selling cryptocurrency. Consider seeking advice from your financial and tax advisor. All custody of and trading in cryptocurrency is performed for Venmo by its licensed service provider, Paxos Trust Company, LLC. Buying, selling, and holding cryptocurrencies is not regulated in many states, including the State of California. Venmo is licensed to engage in virtual currency business activity by the New York State Department of Financial Services. Buying, selling and holding cryptocurrency with Venmo is not available in Hawaii and where prohibited by law. Synchrony does not provide, recommend, or take responsibility for the cryptocurrency program.

6Zero liability for unauthorized use does not include charges by a person to whom you have given authority to use your account or card, and you will be liable for all use by such person.

Apple, the Apple logo, and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. Apple Pay and Apple watch are trademarks of Apple Inc.

Google Pay and Google Wallet are trademarks of Google LLC.

Samsung and Samsung Pay are trademarks or registered trademarks of Samsung Electronics Co., Ltd.

The Venmo Visa Credit Card is issued by Synchrony Bank pursuant to a license from Visa USA Inc. VISA and Visa Signature are registered trademarks of Visa International Service Association and used under license.

The Contactless Indicator mark, consisting of four graduating arcs, is a trademark owned by and used with permission of EMVCo, LLC.