Bold missions. Big dreams. Bright futures.

We're celebrating 10 incredible business owners who received this year's grant.

In May, we partnered with Hello Alice and the Global Entrepreneurship Network to provide $20k each in direct funding to 10 small Venmo businesses.

From expanding their workspaces to investing in new products, these funds help support small business owners as they grow their businesses to the next level.

In partnership with

By providing mentorship, access to networks, and educational resources, these partners support entrepreneurs and help small businesses thrive.

Meet our 2024 recipients

Among tens of thousands of applications, these business owners stood out for their innovative ideas, their inspiring stories, and their commitment to their craft.

Reachable Wellness LLC

Jasmine. H | @reachwellness

Personalized wellness company offering herbal goods and holistic health services.

Soma Metalwork

Kiran. C | @soma_metalwork

Hand-forged chef's knives and homeware, plus blacksmithing classes.

W4 Products LLC

Jenny W. | @dialedinsport

DIALED[IN] Muscle Cream helps the elite and everyday athlete perform better and recover faster, developed by a world champion track cyclist.

Syed Farms

Sumera S. | @syedfarms

A concept meat store specializing in Zabiha Halal chicken and goat meat.

Resident Vinyl

Owen E. | @residentvinyl

Indie record store offering a curated vinyl selection and events that champion local musicians.

The Country Dumplin

Shawn B. | @thecountrydumplin

Delicious baked goods and meals, made without gluten, soy, nuts, and dairy.

Tak Tak

Risa R. | @taktakgoods

Handmade glassware that brings joy, humor, and magic to your everyday ritual.

Pure Intention Services LLC

Erica W. | @pureintentionserv

Mental health care that promotes healing and empowerment for neurodivergent adults.

Bouquet of Basil Herbals

Michelle M.-H. | @bbherbals

Web-based holistic practice led by a Deaf clinical herbalist.

The Traveling Black Women Network

Nadine D. | @travelingblackwomen

A vibrant community connecting and supporting Black female travelers.

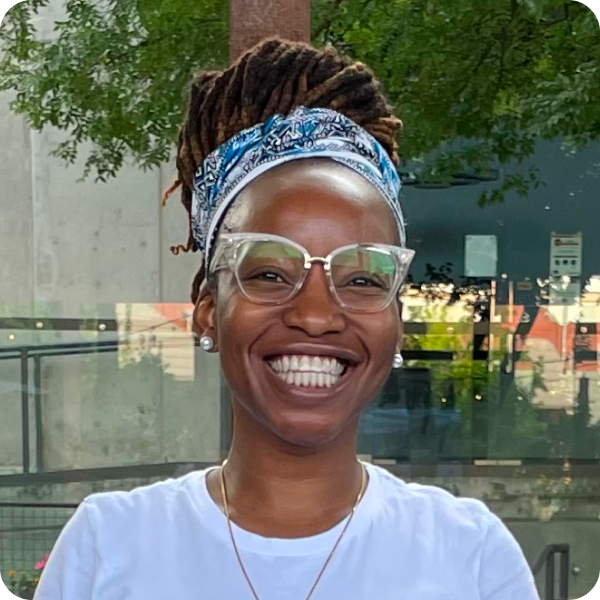

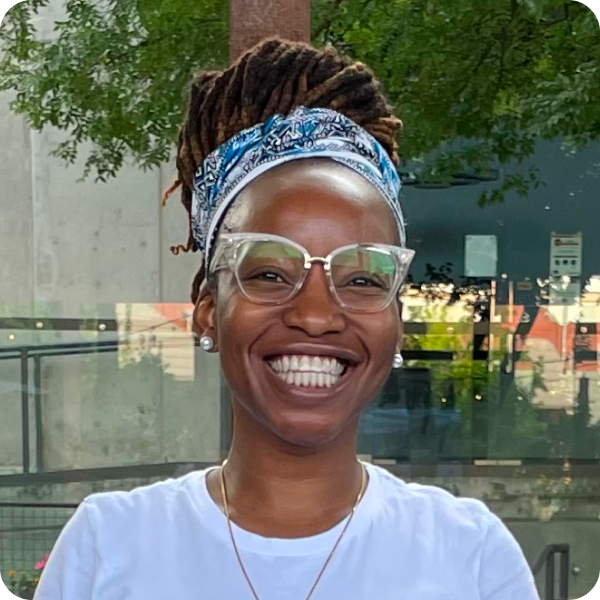

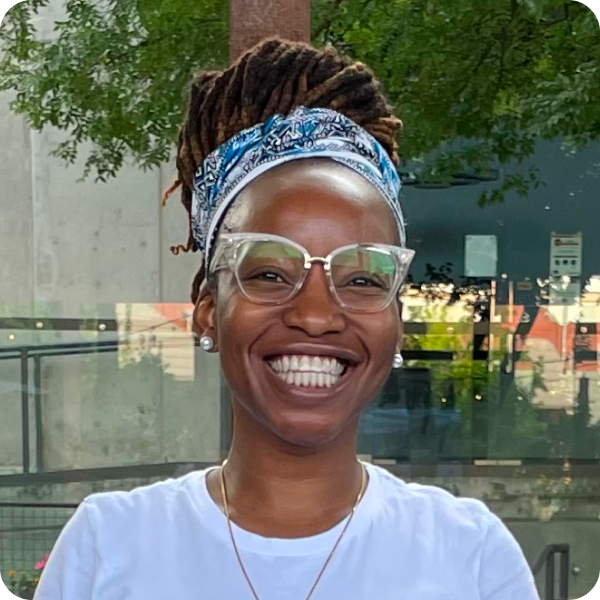

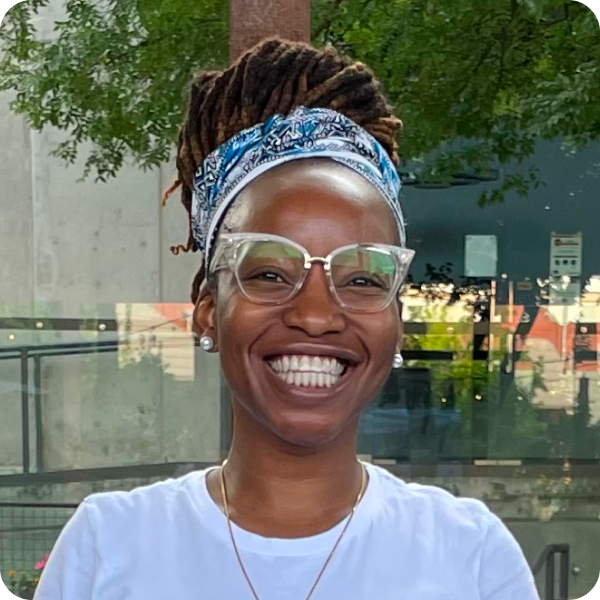

Reachable Wellness LLC

Jasmine. H

@reachwellness

Personalized wellness company offering herbal goods and holistic health services.

Soma Metalwork

Kiran. C

@soma_metalwork

Hand-forged chef's knives and homeware, plus blacksmithing classes.

W4 Products LLC

Jenny W.

@dialedinsport

DIALED[IN] Muscle Cream helps the elite and everyday athlete perform better and recover faster, developed by a world champion track cyclist.

Syed Farms

Sumera S.

@syedfarms

A concept meat store specializing in Zabiha Halal chicken and goat meat.

Resident Vinyl

Owen E.

@residentvinyl

Indie record store offering a curated vinyl selection and events that champion local musicians.

The Country Dumplin

Shawn B.

@thecountrydumplin

Delicious baked goods and meals, made without gluten, soy, nuts, and dairy.

Tak Tak

Risa R.

@taktakgoods

Handmade glassware that brings joy, humor, and magic to your everyday ritual.

Pure Intention Services LLC

Erica W.

@pureintentionserv

Mental health care that promotes healing and empowerment for neurodivergent adults.

Bouquet of Basil Herbals

Michelle M.-H.

@bbherbals

Web-based holistic practice led by a Deaf clinical herbalist.

The Traveling Black Women Network

Nadine D.

@travelingblackwomen

A vibrant community connecting and supporting Black female travelers.

Accept customers' preferred ways to pay—whether it's cards, digital wallets, or Venmo—with just your phone and a business profile.