One credit card.

Now with a $200 bonus.

The Venmo Credit Card lets you earn custom cash back¹ to send, spend, or even to auto-purchase the crypto of your choice from your Venmo account.² Syncing seamlessly with the Venmo app, it’s the simplicity, convenience, and fun you know and love — only more.

For a limited time - score a $200 cash back bonus after you spend $1,000 in the first 6 months of account opening.*

Apply now through March 31st to be eligible for the $200 cash back bonus. Subject to credit approval. See terms below.

Earn smarter

rewards

Automatically earn 3% cash back on your eligible top spend category, 2% on the next, and 1% on the rest¹ — we’ll do the math. All that, with no annual fee.³

Turn your cash back

into crypto

Just toggle on the Purchase crypto feature and choose your favorite of four types of crypto. When cash back is transferred to your Venmo account at the end of every month, we’ll use it to automatically purchase crypto without any crypto transaction fee.

Crypto is volatile, so it can rise and fall in value quickly. Like all currencies, there’s potential for gains and losses — be sure to take it at a pace you’re comfortable with.

- Image

This card has

you written

all over it

Your card comes with your own unique QR code on the front, so it’s a snap to Venmo friends. When they scan your code, up pops your Venmo profile to pay or get paid.

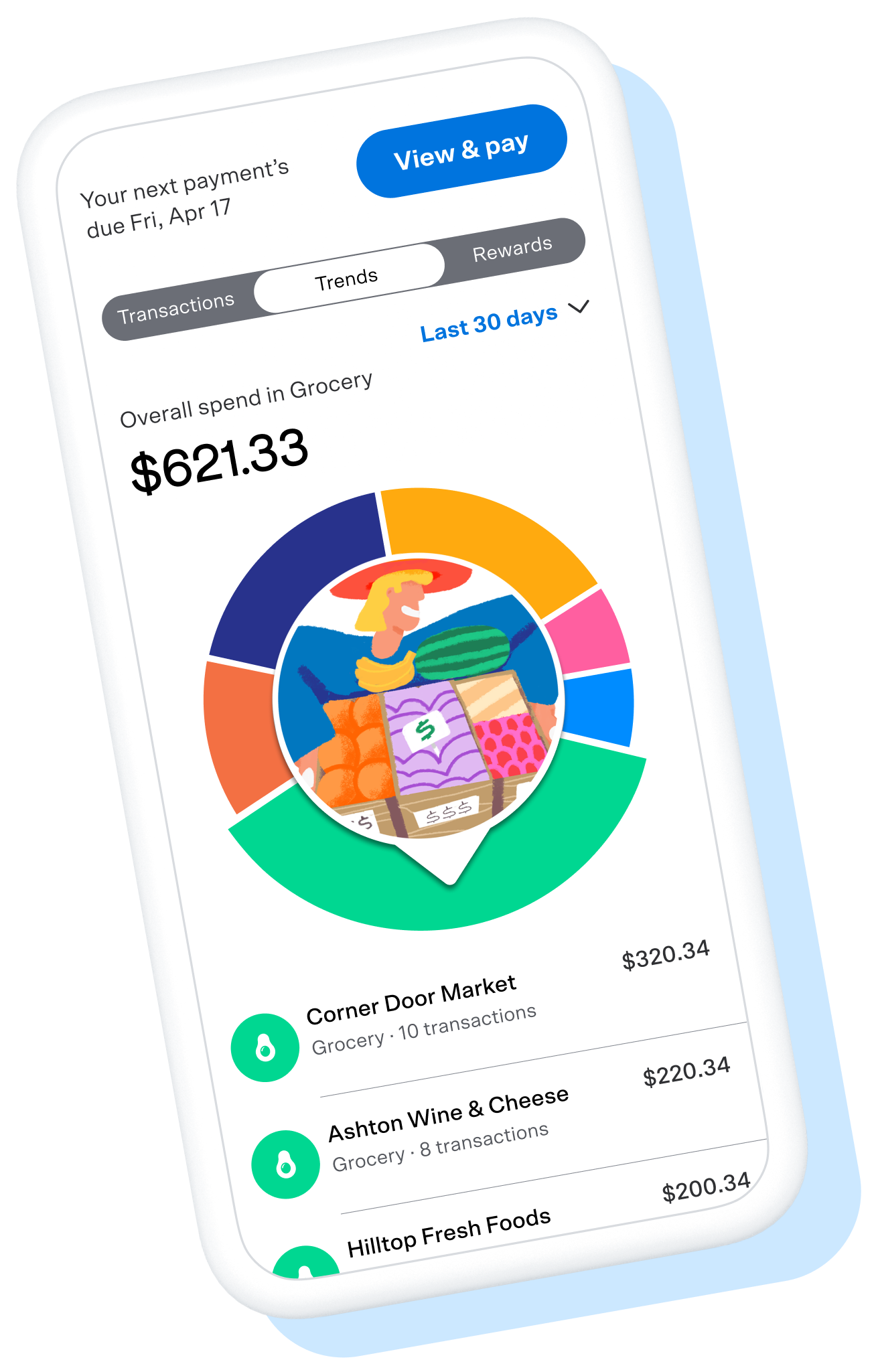

Connected

The Venmo app is your copilot for everything you do with the credit card.

Track it all

Keep tabs on card activity in the app, right alongside your crypto purchases and Venmo spending — every purchase, payment, split, and reward. The Venmo app gives you total control.

Friend-friendly

Pay with the card, then split the cost easily with Venmo friends – just like regular payments. Choose to apply payments from your friends to your Venmo account or directly to your credit card bill.

Shop virtually

Pull up your card details in the app to shop online everywhere Visa® cards are accepted — even before your physical card arrives. Was your card compromised? Simply request your virtual card in the app and keep shopping.

Visa no-worry security

Lost or stolen card? Tap in the app to disable your physical card. Tap to enable when you have it back in your hands. The Visa® Zero Liability Policy⁴ keeps you covered the whole time.

Touch-free

shopping

The Venmo Credit Card is a Visa contactless card and a secure, touch free way to pay on contactless-enabled terminals.

Like color? We’ve got you covered

Pick a card color, then we add your unique Venmo QR code. The best part? When friends scan your code, they’re taken right to your profile to pay or get paid.

Cotton Candy

Night Life

Denim

Campfire

Tropical Islands

Visa® perks

Have peace of mind knowing the card comes with trusted Visa Traditional Credit Card benefits. Plus, Visa Signature® cardholders get access to added travel and lifestyle perks. Woo-hoo!

Have questions?

Get quick answers about the Venmo Credit Card.

Apply for the

Venmo Credit Card

in the app today

The Venmo Credit Card is available for eligible users to apply using the latest version of the Venmo app.

More ways to pay

with Venmo

Shop local

Pay local businesses the same way you pay your friends on Venmo.

Shop in apps & online

Check out with your Venmo balance, then share your finds with friends.

Venmo Debit Card

Take your Venmo balance shopping everywhere Mastercard® is accepted in the U.S.