Dear Venmo ⌄

Educational resources for helping you develop financial skills.

A Q&A about everyday situations and tips related to money.

DEAR VENMO

The community submitted some of their toughest questions. Now, Steven M. Hughes, financial therapist, and Tonya Rapley, certified financial educator, are sharing their thoughts to help you better manage your money, navigate awkward financial situations, and more.

This content reflects advice and experiences from individuals who were compensated. Their advice is not provided on behalf of and does not represent the views of Venmo. Venmo is not making any recommendations regarding finances. Consider seeking advice from your financial advisor.

Carousel

DEAR VENMO

Watch the full series

Explore Dear Venmo and other helpful videos on our YouTube channel. Follow along and you’ll be notified when new content drops.

Watch on Youtube

Meet the experts

Steven M. Hughes, Financial Therapist & Tonya Rapley, Certified Financial Educator

Stephen M. Hughes is a financial therapist focused on helping people understand and improve their relationship with money. Tonya Rapley is a certified financial educator who coaches others on financial decision making.

What’s the best way to structure your money while in college?

Steven M. Hughes, Financial Therapist & Tonya Rapley, Certified Financial Educator

First, understand your monthly expenses so they don’t sneak up on you. Next up, separate your money. Keep your expenses in one place. Then set aside money for dining out, going out, or doing anything social—be sure to keep it separate so it doesn’t interfere with your expenses.

Steven M. Hughes, Financial Therapist...

First, understand your monthly expenses so they don’t sneak up on you. Next up, separate your money. Keep your expenses in one place. Then set aside money for dining out...

First, understand your monthly expenses so they don’t sneak up on you. Next up, separate your money. Keep your expenses in one place. Then set aside money for dining out, going out, or doing anything social—be sure to keep it separate so it doesn’t interfere with your expenses.

Steven M. Hughes, Financial Therapist

Everyone’s financial situation is different; what your roommate can do might not be what you can do. Keep in mind the additional cost of ownership. If you buy a car, what about hidden costs like gas and maintenance? And take advantage of benefits like student discounts wherever you can.

Tonya Rapley, Certified Financial Educator

Juggling college classes and a job? Simplify your money with the Venmo Debit Card and Direct Deposit. It gives you easy access to your rent money, your going-out cash—you name it.

Any tips for couples combining finances for the first time?

Steven M. Hughes, Financial Therapist

When it comes to understanding you and your partner and getting balance in your finances as a couple, it really starts with understanding your money stories.

What are the things you saw and heard about money growing up? Did you have everything that you needed? Was your family able to manage finances without stress? What were your parents’ experiences with money?...

When it comes to understanding you and your partner and getting balance in your finances as a couple, it really starts with understanding your money stories.

What are the things you saw and...

When it comes to understanding you and your partner and getting balance in your finances as a couple, it really starts with understanding your money stories.

What are the things you saw and heard about money growing up? Did you have everything that you needed? Was your family able to manage finances without stress? What were your parents’ experiences with money? Getting clear on these answers for yourself and for your partner will help you better understand why you both think and behave the way you do with your money—and help you set financial objectives for yourselves and for your partnership as you build towards the future.

If you need more resources in communicating about money, connect with a financial therapist.

Steven M. Hughes, Financial Therapist

DEAR VENMO

Watch the full series

Explore Dear Venmo and other helpful videos on our YouTube channel. Follow along and you’ll be notified when new content drops.

Watch on Youtube

Meet the experts

Steven M. Hughes, Financial Therapist & Tonya Rapley, Certified Financial Educator

Stephen M. Hughes is a financial therapist focused on helping people understand and improve their relationship with money. Tonya Rapley is a certified financial educator who coaches others on financial decision making.

What’s the best way to structure your money while in college?

Steven M. Hughes, Financial Therapist & Tonya Rapley, Certified Financial Educator

First, understand your monthly expenses so they don’t sneak up on you. Next up, separate your money. Keep your expenses in one place. Then set aside money for dining out, going out, or doing anything social—be sure to keep it separate so it doesn’t interfere with your expenses.

Steven M. Hughes, Financial Therapist...

First, understand your monthly expenses so they don’t sneak up on you. Next up, separate your money. Keep your expenses in one place. Then set aside money for dining out...

First, understand your monthly expenses so they don’t sneak up on you. Next up, separate your money. Keep your expenses in one place. Then set aside money for dining out, going out, or doing anything social—be sure to keep it separate so it doesn’t interfere with your expenses.

Steven M. Hughes, Financial Therapist

Everyone’s financial situation is different; what your roommate can do might not be what you can do. Keep in mind the additional cost of ownership. If you buy a car, what about hidden costs like gas and maintenance? And take advantage of benefits like student discounts wherever you can.

Tonya Rapley, Certified Financial Educator

Juggling college classes and a job? Simplify your money with the Venmo Debit Card and Direct Deposit. It gives you easy access to your rent money, your going-out cash—you name it.

Any tips for couples combining finances for the first time?

Steven M. Hughes, Financial Therapist

When it comes to understanding you and your partner and getting balance in your finances as a couple, it really starts with understanding your money stories.

What are the things you saw and heard about money growing up? Did you have everything that you needed? Was your family able to manage finances without stress? What were your parents’ experiences with money?...

When it comes to understanding you and your partner and getting balance in your finances as a couple, it really starts with understanding your money stories.

What are the things you saw and...

When it comes to understanding you and your partner and getting balance in your finances as a couple, it really starts with understanding your money stories.

What are the things you saw and heard about money growing up? Did you have everything that you needed? Was your family able to manage finances without stress? What were your parents’ experiences with money? Getting clear on these answers for yourself and for your partner will help you better understand why you both think and behave the way you do with your money—and help you set financial objectives for yourselves and for your partnership as you build towards the future.

If you need more resources in communicating about money, connect with a financial therapist.

Steven M. Hughes, Financial Therapist

DEAR VENMO

Watch the full series

Explore Dear Venmo and other helpful videos on our YouTube channel. Follow along and you’ll be notified when new content drops.

Watch on Youtube

Managing money

Give yourself some time to feel whatever you're feeling. All these emotions that are rushing over you related to your financial decision are valid. I like to say, give yourself 24 hours to curse and carry on—that means putting off making any new financial decisions for the next 24 hours. Don't go into any retail therapy. Don't spend any new money. Just give yourself some time and space to really sit with the financial situation.

Next, make a plan for unexpected situations that pop up in the future. Set aside some money—at least something with a comma in it—so that you can deal with the unexpected, without adding financial stress.

Steven M. Hughes, Financial Therapist

I'm glad you're thinking about this. Co-mingling finances can be a big challenge. You can start by separating your money into a business and a personal account.

You also want to have a clear understanding of what truly is a business expense versus a personal expense. For that, you may want to speak with a financial professional. Set up a system that works for you, keep it consistent, and keep it simple. If you're receiving income from multiple places, consider streamlining that. Options like Venmo help you keep track of everything in one place, business and personal.

Tonya Rapley, Certified Financial Educator

Student loans are challenging for many. The best way to make sure they don’t follow you is to create a plan to manage and eliminate them. Consider career paths and opportunities that allow you to have them forgiven or opportunities that will provide you with a stipend towards eliminating some or all of the balance. The number of employers participating in benefits that assist employees with paying down their student loan debt is also increasing, so consider this when you start job hunting. Student loans can be frustrating, but they don't have to stop you from living your life.

Tonya Rapley, Certified Financial Educator

First, make sure you don't hold resentment toward yourself for the decisions that you made in your 20s. Give yourself grace and know that you did the best you could at the time. Then, you’re ready to gear up for your debt elimination journey.

Steven M. Hughes, Financial Therapist

Debt happens, but you can eliminate it. The first step is to stop creating it. Try removing your credit cards from your wallet and online profiles. Then, list your debt in one place to get an idea of what’s owed. Now you can determine if your income is enough to get control of the situation. If not, consider other opportunities that can earn money specifically for eliminating debit. Commit to the plan and you can begin digging yourself out.

Tonya Rapley, Certified Financial Educator

Many entrepreneurs and creators go through this before they lean into their talents or business full-time. One thing you can do is build a cash reserve—a money runway that will help you pay for your expenses if your income as an artist is low for a month or a few. Start by saving towards 6 months of your expenses.

Also, set a threshold for yourself that you don't want to go under. For example, if you have 3 months of living expenses left in your money runway, you may be interested in getting a part-time job to help alleviate additional stress and give you peace of mind as you focus on your art.

Steven M. Hughes, Financial Therapist

When I first moved to New York City, I had $500 in my bank account, and then when I finally got a job, it wasn't enough to comfortably cover my expenses. I realized that to get ahead of my finances, I had to find a way to make more money as well as reduce my expenses.

Reducing your expenses could start with looking back at your spending for the month and finding places to cut things out. Ask yourself, do I have any additional opportunities to bring in more income? Whether that's getting a side hustle, getting a raise or selling some of the things that I have in my home or in my closet.

Remember that stabilizing our finances is about reducing our expenses and increasing our income.

Tonya Rapley, Certified Financial Educator

That’s ok. Most people didn’t, but money management is a necessary skill. Remember that everything you hear online is not always true, so look for certified experts. Podcasts are also a great place to learn about money and new topics.

Tonya Rapley, Certified Financial Educator

We didn't talk about money growing up unless it was about how much we didn’t have. As I repaired my financial life, I found several cycles that I believe we all go through:

Shift your money mindset: Give affirmations and declarations a try.

Stabilize your household: Find a helpful resource to learn from, like a book or podcast.

Sustain good habits: Ask a friend or family member to be your accountability partner.

Save up: Make a plan that brings you closer to your goals.

Steven M. Hughes, Financial Therapist

First off, there's no shame in the saving money game. Don't feel bad about being on a family plan if it still suits your needs. Plus, family plans generally cost less per person than an individual plan. Now, if you are not getting what you need out of the family plan, like data, international travel call and text capabilities, or something else, it may be time to look for your own phone plan. Just don't do it out of the want of proving to someone that you can pay your own phone bill. That's not the flex you think it is.

Steven M. Hughes, Financial Therapist

Work burnout is real and shouldn’t be taken lightly but remember to act in a way that considers your finances. Before quitting, try discussing your issues with a manager or moving to a different department. If you’re out of options, you’ll need a financial buffer that covers your everyday responsibilities and potential emergencies.

Tonya Rapley, Certified Financial Educator

Saving a minimum of 6-12 months' worth of expenses can help put your mind at ease. You don’t want to create financial stress while recovering from burnout.

If you can, find someone to talk to. Quitting your job is a big decision and having guidance on its financial and holistic impact can help you decide what’s next. Check out what resources are available for you through your company as well

Steven M. Hughes, Financial Therapist

Money, friends, and relationships

A social life is important, just ensure that you create boundaries. That can mean setting a dining-out budget or resisting the urge to pay for others when you shouldn’t. Once you’ve exhausted the budget, consider why you dine out besides socializing. For many, stocking the kitchen with items that are easy to cook when you’re low on time and energy, and new things to explore for when you aren’t, can fight boredom and help create a better routine.

Tonya Rapley, Certified Financial Educator

Keeping an eye on your dining-out expenses? The Venmo Debit Card makes it easy to earn cashback1 on groceries and takeout, then settle up with friends in a few taps.

Not at all. Sometimes people’s life timelines don’t align with others and that’s ok. We should celebrate milestones with those closest to us, but not at the expense of our financial comfort.

Tonya Rapley, Certified Financial Educator

I missed multiple weddings and birthdays while repairing my finances. I was always clear to friends that I loved them but wasn’t in the position to make the trip. It’s hard, but never equate your love to your financial net worth.

If you save money by not travelling, you may also have cash to send a gift or contribute to a virtual honeymoon fund.

Steven M. Hughes, Financial Therapist

Late to the registry, or too many items out of your price range? Tap the gifting icon in the app and gift-wrap your Venmo payment instead.

First off, remember it’s super easy to nudge your roommates by sending them a payment reminder in Venmo. The next step would be to have a conversation with your roommates about revisiting the way you share utility costs. Maybe someone else is willing to pay for the utilities going forward, with you sending your share to them.

Here are some guidelines for talking to a roommate, friend or family member about money:

Ask open-ended questions and avoid ultimatums.

Focus on solutions to the topic at hand.

Remember that this isn't the last money conversation you will have together, so you don’t have to put too much pressure on yourselves.

Steven M. Hughes, Financial Therapist

Find pending requests in the transactions tab, tap Remind, and Venmo will re-send the notification for you.

Two things may be happening here. Either everybody in your friend group is going on vacation, or your social media feed is giving you FOMO. When it comes to keeping FOMO in check, see how you’re really feeling about the idea of travel. If you decide you are looking to travel, give yourself some space to mentally go where you want to go.

Visualizing your trip can be a powerful trigger to save towards your travel. When it comes to keeping your finances in check, give your money a job and let it go to work; make a plan for your income to fund your upcoming trip. Whether it’s travel or something else, know that you can and should use your money to experience the things that light you up, the things that feed you at your core.

Steven M. Hughes, Financial Therapist

As someone who had their first job as a busboy in a famous steakhouse chain, this hits home.

Historically, many service industry workers don't get paid an equitable wage. Ask your friends to help you change that—and make sure your favorite restaurants can keep going and growing—by tipping. Our natural human instinct is to help and you can help guide your friends away from under-tipping.

Steven M. Hughes, Financial Therapist

Manage your money

with Venmo.

The perfect sidekick.

A Venmo Debit Card helps you track even more expenses while earning cashback1 on everyday purchases. Plus, get paychecks up to 2 days early with Direct Deposit on Venmo.2

Discover new potential.

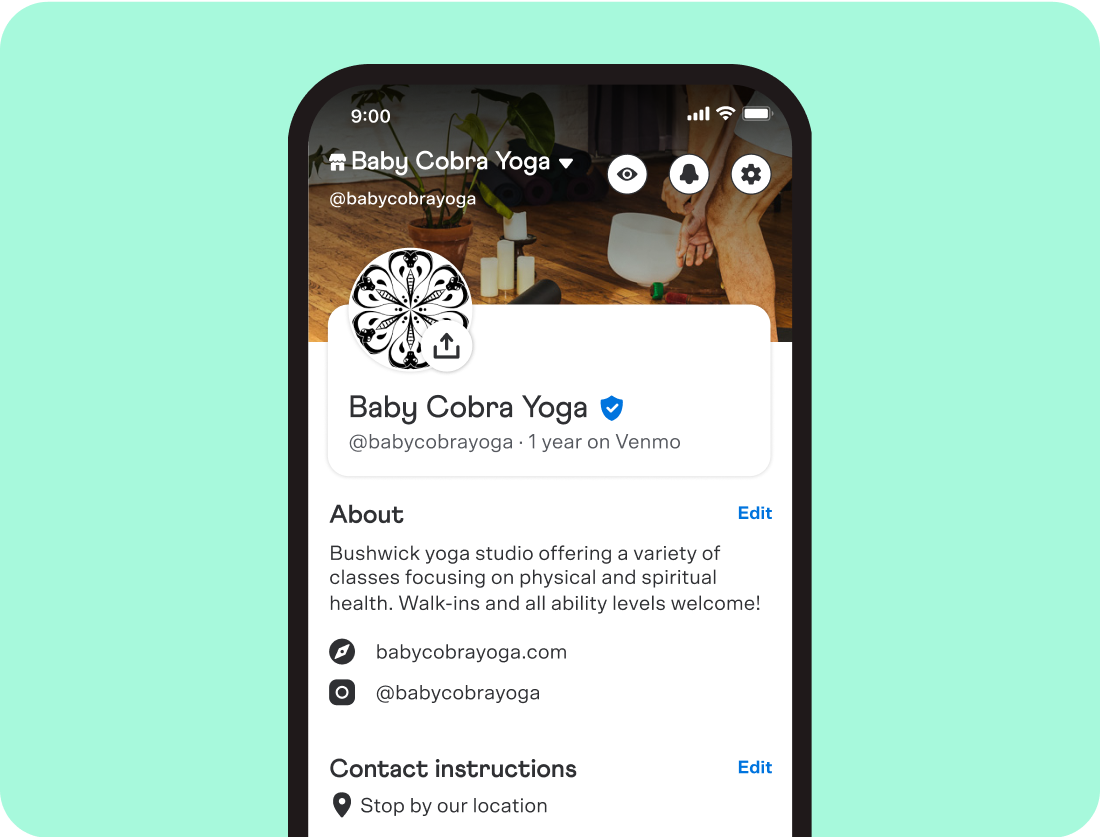

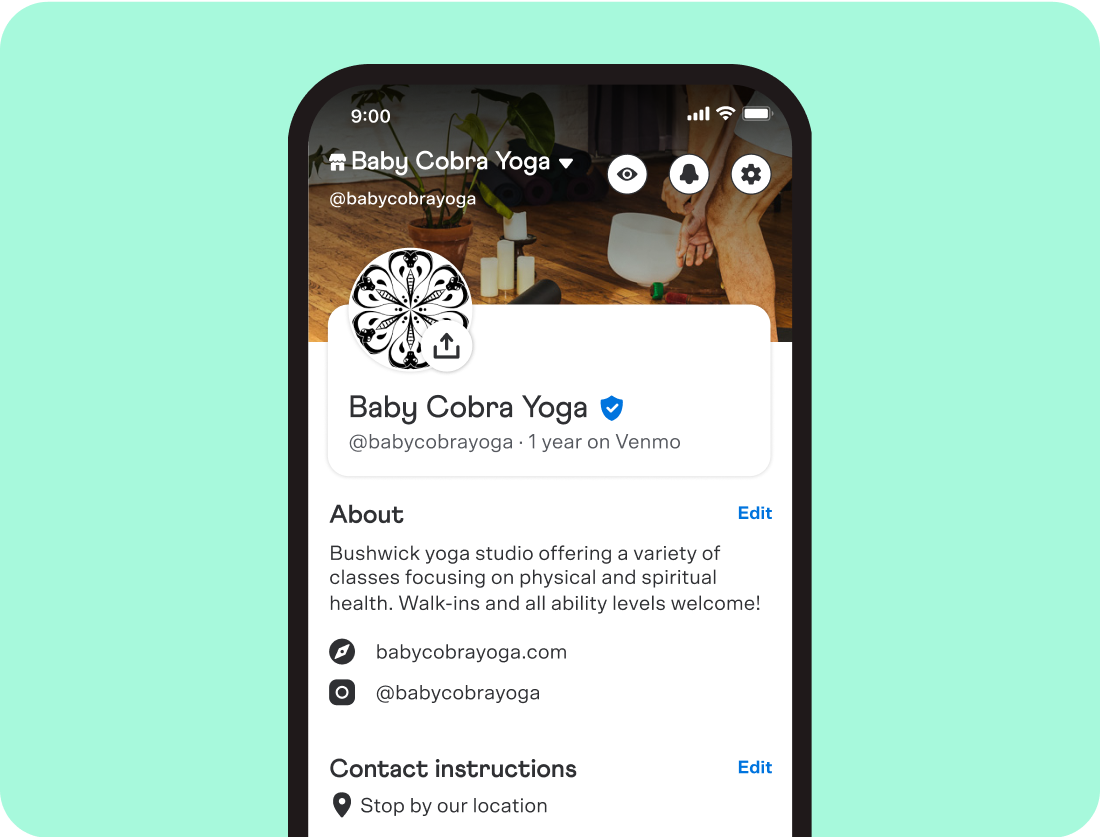

Accept more payments methods, including tips, and connect with customers using a Venmo business profile.